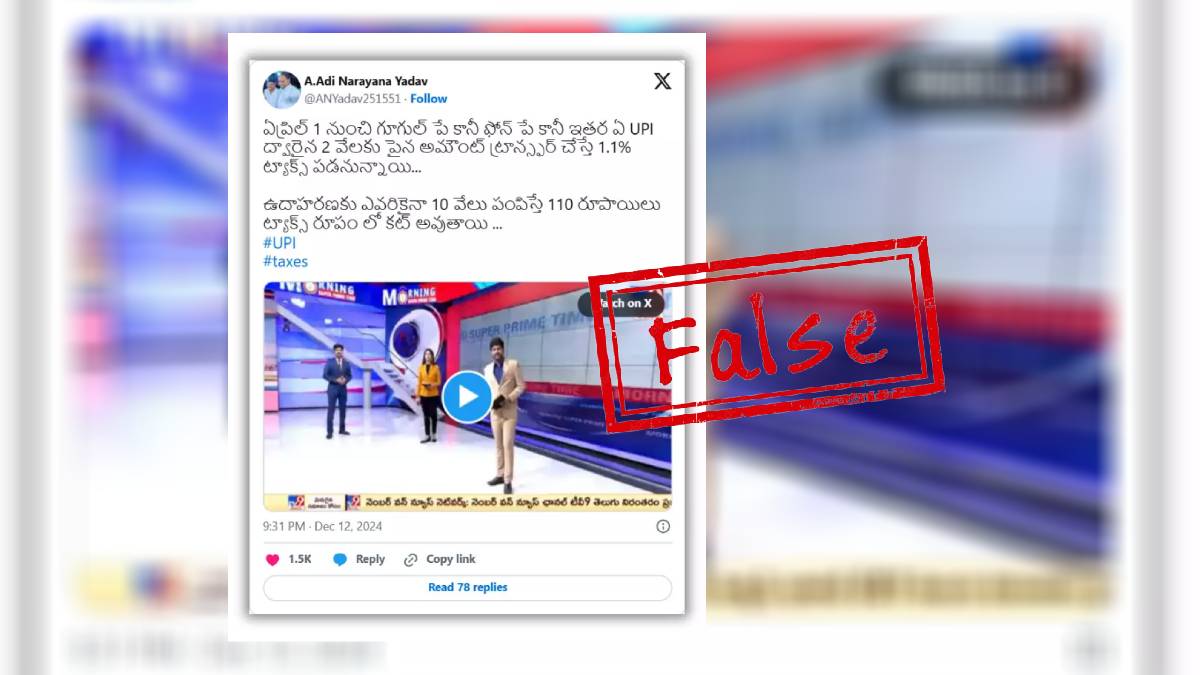

UPI (Unified Payments Interface) has slowly become one of India’s most commonly used payment options. However, a post claiming that from April 1, 2025, a 1.1 per cent tax will be levied on UPI transactions is going viral.

Claim:

An X user shared the claim on social media and wrote, “From April 1, if you transfer an amount above Rs 2,000 through Google Pay, Phone Pay or any other UPI, a 1.1 per cent tax will be levied. For example, if you send Rs 10,000 to someone, Rs 110 will be deducted as tax.” (Translated from Telugu) (Archive)

Investigation:

NewsMeter found that the claim is false. The tax is only applicable on PPI merchant transactions over Rs 2,000. Prepaid Payment Instruments (PPIs) are tools that allow customers to store money in a wallet and conduct transactions.

Along with the viral claim, the user shared a video of a TV9 Telugu bulletin about the tax. In the bulletin, TV9 stated that the tax is applicable only on payments made using wallets and cards. However, we were unable to find the clip on YouTube for further clarification.

Using a keyword search, we found a report by The Hindu published on March 30, 2023, with the title ‘PPI merchant transactions of over ₹2,000 to attract 1.1% charge from April 1.’ According to the report, “Starting April 1, merchant transactions exceeding ₹2,000 in value done using Prepaid Payment Instruments (PPI Wallets) on UPI will attract an interchange charge of 1.1%.”

Quoting the National Payments Corporation of India (NPCI), which governs UPI, the report said that the new interchange charges are only applicable for PPI merchant transactions and there will be no charge for other regular customers.

From the report, we can see that the 1.1 per cent tax on PPI merchant transactions above Rs 2,000 came into effect from April 1, 2023.

We also found a post by PIB Fact Check shared on March 29, 2023, that addressed a similar claim. The post read, “There is no charge on normal UPI transactions. @NPCI_NPCI circular is about transactions using Prepaid Payment Instruments (PPI) like digital wallets. 99.9% transactions are not PPI.” (Archive)

What is the difference between transactions in UPI and UPI wallets?

A Moneycontrol report published on October 21, 2024, titled ‘UPI Vs UPI Wallet: Why switching to UPI Wallets for small payments is a smart move’ detailed the differences between the two.

The report stated, “UPI is a payment system that allows instant money transfers between two bank accounts via a mobile device, using apps like Google Pay, PhonePe, Amazon Pay or Paytm. UPI Wallets, on the other hand, are prepaid wallets linked to your UPI apps that store a balance and can be used for smaller transactions without directly accessing your bank account.”

How does the 1.1% tax on PPI merchant transactions affect an average UPI user?

Another report on UPI transactions published by Fi Money on August 21, 2024, explained the charges behind UPI transactions.

According to the article, titled ‘Will you be charged for UPI? Clearing out the confusion’, the NPCI has clarified that the charges are only applicable for payments made through prepaid wallets such as PhonePe or Paytm wallets, and not for bank-to-bank transfers.”

“The reason for this distinction is that pre-paid wallets charge a fee for adding money to the wallet, and the NPCI believes that these charges will help offset the cost of this fee,” said the report. The report also stated that the new charges on UPI payments announced by NPCI should not be a cause for concern for the average UPI user as they are only applicable to merchants who receive payments through pre-paid wallets.

From the above reports, we can see that the 1.1 per cent tax is applicable only on PPI merchant transactions over Rs 2,000 and has been in effect since April 1, 2023. This tax does not affect the transactions of an average UPI user making bank-to-bank transfers.

Therefore, NewsMeter concludes that the claim is false.

Conclusion: The claim that transferring an amount above ₹2,000 through Google Pay, PhonePe, or any other UPI platform will incur a 1.1% tax is incorrect. This viral claim is false.

(This fact-check article was originally published by Newsmeter and has been republished by Lighthouse Journalism as a part of Shakti Collective.)